It’s the Circle of Trade

Pete and Repeat walk into a bar. Pete walks out. Who’s left?

The answer is the U.S.-China trade war. Duh…

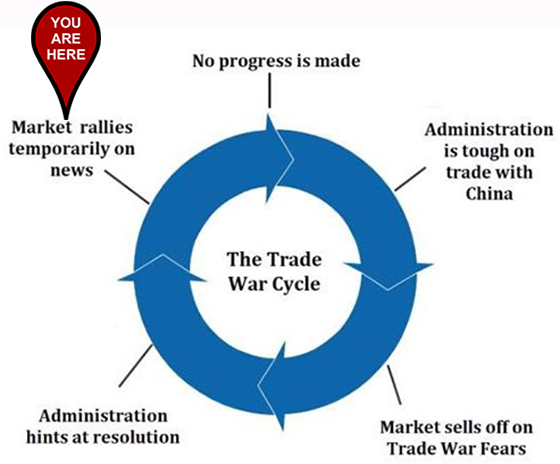

We’re once again in the “market rallies temporarily on news” phase of the Great Stuff Trade War Cycle chart. And, as you might suspect, we’re being fed the same lines we were about this time last year.

This morning, Vice Premier Liu He and other Chinese officials spoke on the phone with U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin. The topic of the conversation? Agreeing to talks on a “phase 1” trade deal … again.

According to Xinhua News Agency — China’s official news agency — the representatives discussed “solving issues regarding each other’s core concerns, reached consensus on properly resolving related issues and agreed to maintain communication on remaining issues.”

At the time of this writing, however, U.S. representatives had not confirmed the announcement … again.

The Takeaway:

Once again, we have promises of advancing trade talks. “We’re close to a deal,” they say. “We’re making progress,” they say. “Removing tariffs is on the table,” they say.

Remember how this played out last time? Optimism grew to such a point that nearly every mainstream media outlet reported that the U.S. would roll back tariffs to sign a phase 1 trade deal. It appeared that China had won out over the U.S. due to tariff concessions.

Then President Trump spoke … and the whole thing was practically reset to zero. Well, not exactly to zero. Trump promised that if China didn’t sign a trade deal, he would massively increase tariffs.

This time around, there’s optimism in the rally, but that optimism is muted. It’s understandable. Markets are already near all-time highs, and Wall Street has yet to hear from President Trump on this latest development.

The question is, however, has Wall Street grown a thicker skin when it comes to trade war optimism, or is there just not enough gas left in the tank to push stocks even higher?

I’ll admit, that’s a “gotcha” question. There’s plenty of money on the sidelines right now, waiting for a resolution in the U.S.-China trade war. There’s plenty of gas in the tank. But, without a trade deal — even a phase 1 trade deal — there’s no real reason to press the accelerator.

Here’s your updated Great Stuff Trade War Cycle chart:

The ball’s in your court, Trump. Do we make progress, or is it time to “get tough” once again?

The Good: Showroom No More

Once dubbed Amazon’s showroom, Best Buy Co. Inc. (NYSE: BBY) has made an impressive comeback … and its recent quarterly report underscores this fact.

The big-box electronics retailer beat Wall Street’s third-quarter earnings estimates by $0.09 per share, with revenue arriving at $9.76 billion — also ahead of estimates. Best Buy also put current quarterly earnings and revenue ahead of consensus targets. (That’s a lot of HDMI cables … just saying.)

But the company didn’t stop with the beat-and-raise quarterly performance. Best Buy also indicated it was going head-to-head with Amazon.com Inc. (Nasdaq: AMZN) this holiday season.

“Customers ordering online will get free next-day delivery on thousands of items all season long with no membership or minimum purchase required. They can also choose to pick up their products in a store within an hour of placing their order,” CEO Corie Barry said.

That “no membership or minimum purchase” quip was clearly a dig at Amazon. With Black Friday just days away, it’s time to see if Best Buy can back up this bravado.

The Bad: Timber!

Shares of Dollar Tree Inc. (Nasdaq: DLTR) are falling hard today after the company missed earnings targets and guided lower.

Growth was hard to come by for Dollar Tree last quarter, with earnings falling about 8.5% to $1.08 per share from year-ago levels. Analysts were expecting earnings of $1.13 per share.

Revenue also failed to impress, coming up short at $5.75 billion, while same-store sales grew a less-than-expected 2.5%.

The root of Dollar Tree’s problem is Chinese tariffs. The company even revised its fourth-quarter outlook below Wall Street’s targets due to trade-war tensions.

“The Company now estimates that Section 301 tariffs will increase its cost of goods sold by approximately $19 million, or $0.06 per diluted share, in the fourth quarter of 2019 if tariffs are fully implemented,” Dollar Tree said.

If the current trade war pattern continues, it looks like tariffs won’t leaf Dollar Tree alone anytime soon … I’ll see myself out.

The Ugly: The FDA Channels Miss Cleo

The U.S. Food and Drug Administration (FDA) decided it had been too long since it took a shot at the cannabis market, so it decided to weigh in once again last night.

This summer, the FDA warned that it was looking into cannabidiol (CBD) due to its growing widespread usage. Last night, the organization said that due to a lack of scientific data, it cannot determine if CBD is “generally recognized as safe among qualified experts for use in human and animal food.”

The FDA also said that CBD “can cause” liver injury, interact with other medications and cause drowsiness when used with alcohol.

In short, the FDA just described pretty much every unregulated supplement on the market. You could literally walk into any GNC in the country and find products that meet the same description.

But the FDA didn’t stop there. It announced that it had sent warning letters to 15 U.S. companies that it said were illegally selling products containing CBD.

Along those lines, the FDA graciously reminded us that Epidiolex — a patented brand-name prescription medication from GW Pharmaceuticals PLC (Nasdaq: GWPH) — is the only approved CBD product on the market.

So, unprompted, the FDA shows up, issues a warning with no scientific backing and reminds us of an approved prescription product. Umm … thank you, FDA?

Next time it pops up, I hope it has a bit more information. It would be helpful.

Do you like pie? I love pie.

Pie can sometimes be a great conversation starter. “Did you try Aunt Becky’s pumpkin pie? It’s delicious!”

Today’s Chart of the Week kind of pie … you might want to really consider before bringing it up at Thanksgiving dinner:

This pie chart comes courtesy of Rex Nutting over at MarketWatch. The moment I saw it, I knew I had to run it past my good friend Ted Bauman, editor of The Bauman Letter.

Here’s Ted’s unfiltered take:

If families operated the way the U.S. economy does, 90% of us would spend our lives serving the other 10%. Half the family would try to make ends meet by borrowing money from the rest of us to afford the rent we charge them for living in the basement.

Those of us in the middle would worry about our wealthy relatives blowing up the family fortune with speculation and our poor relatives losing patience and bashing down the basement door.

There’s nothing wrong with making a fortune in honest business. But increasingly, the American economy revolves around chiseling money out of the majority by charging high prices for low-quality products in uncompetitive markets.

This leaves ordinary American families with so little income that they’re forced to borrow to make ends meet, funneling yet more money to the top of the pile in the form of interest payments.

It’s a dire thought at Thanksgiving time, but it’s true. The sooner Americans realized that their struggles are not their fault, but the result of a system that falls far short of the free market ideal, the better.

If Ted’s wake-up call resonated with you, or if you’re just tired of getting a smaller piece of the pie, you need to subscribe to The Bauman Letter.

Great Stuff: Tis the Season for Sharing!

Tis the season for sharing and giving thanks!

What snarkier way to tell someone “I care about you and your financial well-being” than to share today’s copy of Great Stuff with them?

You aren’t hoarding all this great financial information for yourself, are you?

I mean, I wouldn’t blame you. If I had a financial e-zine with a trading chart that could help me make billions, I’d keep it quiet, too.

No. No. No! We’re not grinches here. We share with our fellow investors. After all, we’d all like a bigger slice of pie.

Sharing is caring, and Great Stuff cares.

So, if you have a friend who still gets their daily financial news in that dry, Waspy old format from the major financial publications, forward them today’s copy of Great Stuff.

Or, send them here to sign up now!

Liven up their day. Help them make billions too!

They’ll thank you for it.

Finally, don’t forget to like and follow Great Stuff on Facebook, Twitter and Instagram!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing

from Timor Invest https://ift.tt/33oQRpr

Комментариев нет:

Отправить комментарий