Through Tuesday, October 15, 2019

Charts and commentary courtesy of CountingPips.com

Tables courtesy of GoldSeek

Note: Commitment of Traders reports are published Friday with data from the previous Tuesday.

Gold Non-Commercial Speculator Positions:

Large precious metals speculators strongly cut back on their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 253,027 contracts in the data reported through Tuesday October 15th. This was a weekly decline of -22,536 net contracts from the previous week which had a total of 275,563 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -15,013 contracts (to a weekly total of 319,370 contracts) while the gross bearish position (shorts) increased by 7,523 contracts for the week (to a total of 66,343 contracts).

Gold speculators sharply reduced their bullish bets for the second time out of the past three weeks and have now trimmed off a total of -59,417 contracts in that time-frame. Previously, gold speculators had been steadily raising their bullish positions which culminated with a jump to a three-year high on September 24th at over +312,000 contracts. Currently, the overall bullish standing has now dipped to the lowest level since July 23rd, a span of twelve weeks.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -288,275 contracts on the week. This was a weekly boost of 22,667 contracts from the total net of -310,942 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1483.50 which was a decline of $-20.40 from the previous close of $1503.90, according to unofficial market data.

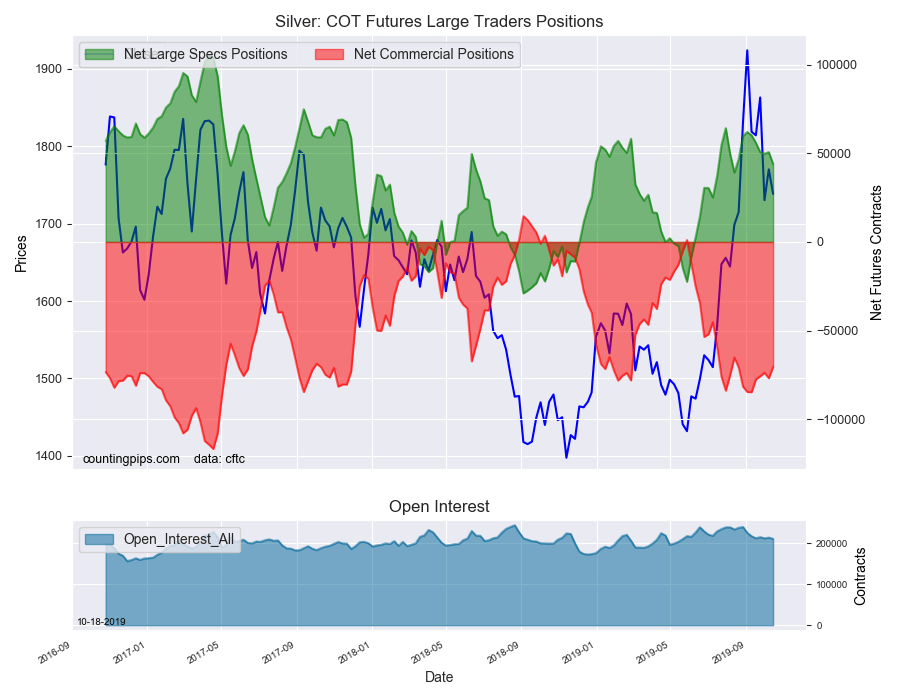

Silver speculators cut back bullish bets for 5th time in 6 weeks

Silver Non-Commercial Speculator Positions:

Large precious metals speculators once again decreased their bullish net positions in the Silver futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Silver futures, traded by large speculators and hedge funds, totaled a net position of 43,989 contracts in the data reported through Tuesday October 15th. This was a weekly decline of -6,765 net contracts from the previous week which had a total of 50,754 net contracts.

The week’s net position was the result of the gross bullish position (longs) tumbling by -5,004 contracts (to a weekly total of 85,088 contracts) while the gross bearish position (shorts) gained by 1,761 contracts for the week (to a total of 41,099 contracts).

Silver speculators reduced their bullish bets for the fifth time out of the past six weeks. This recent drop in sentiment follows the strong run over the summer that had seen bullish positions rise in ten out of the previous fourteen weeks. The overall bullish standing is now at the lowest level of the past nine weeks, dating back to August 13th.

Silver Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -70,487 contracts on the week. This was a weekly boost of 6,419 contracts from the total net of -76,906 contracts reported the previous week.

Silver Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Silver Futures (Front Month) closed at approximately $1738.40 which was a fall of $-31.60 from the previous close of $1770.00, according to unofficial market data.

Speculators shed US Dollar Index bets for 2nd week

US Dollar Index Speculator Positions

Large currency speculators decreased their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 37,436 contracts in the data reported through Tuesday October 15th. This was a weekly reduction of -2,423 contracts from the previous week which had a total of 39,859 net contracts.

This week’s net position was the result of the gross bullish position (longs) dropping by -4,689 contracts (to a weekly total of 44,288 contracts) compared to the gross bearish position (shorts) which saw a lesser decrease by -2,266 contracts on the week (to a total of 6,852 contracts).

US Dollar Index speculators dropped their bullish bets for a second straight this week following a streak of six consecutive weekly gains. The dollar positioning s now under the +40,000 net position for a second straight week after bets had ascended to a 127-week high at +43,028 net contracts on October 1st.

from Timor Invest https://ift.tt/2J6PBzT

Комментариев нет:

Отправить комментарий