вторник, 31 декабря 2019 г.

Ring in the New Year With a Tax-Free Passive Income Stream!

What better way to ring in the New Year than with a gift that keeps on giving?

Over the holiday season, we typically spend more money than we had planned. Around New Year’s, we make resolutions to cut back. Then in the next year, the cycle repeats itself.

One great way to break the cycle is to give yourself the gift of tax-free income.

Thanks to the Tax-Free Savings Account (TFSA), it’s possible to buy investments without worrying about taxes. Similar to RRSPs, TFSAs give you tax-free growth. Unlike RRSPs, however, they also let you withdraw tax-free.

This makes the TFSA the perfect account to establish a tax-free income stream — one that can help you pay for the holidays next year without breaking the bank.

Investors can now contribute up to $69,500 to a TFSA

TFSA contribution room is cumulative, meaning that every year you get an additional amount of contribution space plus whatever you have left from past years.

In 2020, investors who were at least 18 in 2009 will have $69,500 worth of contribution space. At a 4% average yield, a portfolio of that size will produce $2,700 a year in dividend income–more than enough to cover the average Canadian family’s Christmas expenses.

A solid TFSA income pick

If you’re looking to establish your own TFSA income stream, a greater beginner pick would be the iShares S&P/TSX 60 Index Fund (TSX:XIU). As a diversified, low-fee index ETF, it gives you built-in diversification and spares you having to painstakingly research individual stocks.

Although XIU’s dividend yield (2.8%) isn’t quite enough to get the $2,700 a year in income mentioned above, it can produce a substantial amount in its own right (about $1,950 a year) with $69,500 invested.

More important, as an index fund, it’s not actively managed, which means that you’re guaranteed to replicate the performance of the target benchmark (the TSX 60) and will pay low fees.

Why recommend XIU as opposed to another Canadian index fund?

Personally, I favour XIU to XIC–the obvious runner-up–for a few reasons.

With its concentration on large caps, XIU has fewer high-risk components than does XIC.

As a more popular fund, it’s more liquid.

Finally, XIU has enjoyed slightly better performance than XIC historically. There’s no guarantee that that will remain the case, but it holds over a pretty long time frame.

If you wanted to diversify your TFSA ETF portfolio a little, I’d consider adding a U.S. fund like the Vanguard S&P 500 Index Fund, but I’m personally comfortable keeping my entire Canadian ETF portfolio in XIU.

Foolish takeaway

If the holiday season is about spending, then the New Year is about saving. After the gift giving bonanza of Christmas, New Year’s can be a great time to cut back on spending and get your finances in order.

One great way to do that is to hold income-producing investments in a TFSA and keep receiving tax-free gifts every quarter the whole year round.

5 TSX Stocks for Building Wealth After 50

BRAND NEW! For a limited time, The Motley Fool Canada is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50.

So if you’re looking to get your finances on track and you’re in or near retirement – we’ve got you covered!

You’re invited. Simply click the link below to discover all 5 shares we’re expressly recommending for INVESTORS 50 and OVER. To scoop up your FREE copy, simply click the link below right now. But you will want to hurry – this free report is available for a brief time only.

Fool contributor Andrew Button owns shares of iSHARES SP TSX 60 INDEX FUND.

from Timor Invest https://ift.tt/36dXWex

3 High-Yield Dividend Stocks to Buy in 2020

The New Year is upon us, and what better time to go shopping for stocks?

It’s a Holiday tradition to go bargain hunting after Christmas, and while the TSX as a whole is fairly expensive right now, there are still plenty of boxing week sales to be found.

Also, many of the stocks currently on sale have high yields and rising payouts that can reward you handsomely in the years ahead.

With that in mind, here are three of the best high-yield dividend stocks to buy in 2020.

Enbridge

Enbridge Inc (TSX:ENB)(NYSE:ENB) is Canada’s biggest and best pipeline company, shipping crude oil and LNG all over North America.

The stock sports a whopping yield of 6.24% as of this writing, and management has been raising the dividend by 17% a year on average. This year the dividend was increased 10%.

Over the last four years, Enbridge has increased its net income from $250 million to $2.8 billion. That’s a fantastic growth rate, and it looks set to continue.

Not only did ENB crank out $3.1 billion in adjusted EBITDA in its most recent quarter, but it also has two big infrastructure projects in the works (the Line III replacement and Line V tunnel) that could drive higher earnings.

Fortis

Fortis Inc (TSX:FTS)(NYSE:FTS) is one of Canada’s oldest and largest publicly traded utilities. With $53 billion in assets and 3.3 million customers, it’s a true utility giant.

FTS is well known as one of Canada’s most dependable dividend stocks. It has a 3.5% yield today and has raised its dividend every single year for 46 years.

Over the next five years, Fortis will be undertaking a capital expenditure program aimed at increasing its rate base. The program will cost $18.3 billion and will replace aging infrastructure and increase service area.

The program should increase revenue, but will also increase the amount of debt on Fortis’ already heavily leveraged balance sheet.

Algonquin Power & Utilities

Algonquin Power & Utilities Corp (TSX:AQN)(NYSE:AQN) is another Canadian utility company. Compared to Fortis, it’s a smaller player, but has enjoyed far better returns over the past 10 years.

Since December 31, 2009, AQN shares have risen 355%. That’s a phenomenal return for a utility stock, as utilities are generally considered to be “slow and steady” dividend plays that deliver about market-average returns.

With that said, Algonquin’s capital gains have not come at the expense of income. Even with its 355% 10-year return, AQN still yields 4%, and management has been raising the dividend over the years.

This makes the stock a solid dividend play that could also deliver some capital gains if the company keeps growing.

As for whether Algonquin will keep growing, that remains to be seen. One encouraging fact about the company is that it has major investments in renewable energy, which position it well for the decade ahead, with its likely increase in climate change-related regulations.

Such regulations will be hard on utility companies that burn coal, but should leave wind, solar and hydro producers (like Algonquin) relatively unscathed.

5 TSX Stocks for Building Wealth After 50

BRAND NEW! For a limited time, The Motley Fool Canada is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50.

So if you’re looking to get your finances on track and you’re in or near retirement – we’ve got you covered!

You’re invited. Simply click the link below to discover all 5 shares we’re expressly recommending for INVESTORS 50 and OVER. To scoop up your FREE copy, simply click the link below right now. But you will want to hurry – this free report is available for a brief time only.

Fool contributor Andrew Button has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Enbridge. Enbridge is a recommendation of Stock Advisor Canada.

from Timor Invest https://ift.tt/36eDBG3

Chrome Browser Extension Ethereum Wallet Injects Malicious JavaScript To Steal Data

An Ethereum (ETH) wallet known as “Shitcoin Wallet” is reportedly injecting malicious javascript code from open browser windows to steal data from its users. On Dec. 30, cybersecurity and anti-phishing expert Harry Denley warned about the potential breach in a tweet:

– Source Twitter

According to Denley’s tweet, Chrome browser crypto wallet software Shitcoin Wallet is targeting Binance, MyEtherWallet and other well-known websites containing users’ passwords and private keys to cryptocurrency.

The Shitcoin Wallet Chrome extension – ExtensionID: ckkgmccefffnbbalkmbbgebbojjogffn – works by downloading a number of javascript files from a remote server. The code then searches for open browser windows containing webpages of exchanges and Ethereum network tools.

The code attempts to scrape data input into those windows. Once it does, the information is sent to a remote server identified as “erc20wallet.tk,” which is a top-level domain address belonging to Tokelau, a group of South Pacific Islands that are part of New Zealand’s territory.

Google Chrome removed MetaMask, but for different reasons

Shitcoin Wallet stealing user data may sound similar to recent incidents including Apple threatening to unlist Coinbase’s mobile DApp browser from its app store and Google removing Ethereum wallet app MetaMask from its Google Play App Store last week. Both of those instances, however, have been subject to considerable controversy due to lack of evidence of malicious conduct on the part of those apps.

A number of cryptojacking extensions were found on the Google Chrome web store last year. According to a recent report from McAfee Labs, cryptojacking, which occurs when a user’s computing device is secretly used to mine cryptocurrency, has been on the rise, up 29% in Q1 2019.

Shitcoin Wallet was built for trouble online

While the name should be a dead giveaway that it’s better to stay away from this particular Ethereum wallet software, Shitcoin Wallet contains some suspicious added features.

According to a company blog post, the Ethereum wallet, which launched on Dec. 9 and claims to have over 2,000 users, is a web-based wallet that has several extensions for different browsers. The blog post notes;

“It is a web wallet which has several extensions for different browsers, which I will discuss further in the article.”

However, this doesn’t square with what the company mentions at the end of that very blog post, which says/reads that Shitcoin Wallet is currently only supported by Chrome.

A few days prior to the malicious javascript attack, Shitcoin Wallet announced the launch of its new desktop app, giving away 0.05 ETH to users who download and install the Shitcoin Wallet desktop app.

While those users may have received a bit of free ETH, they are now left vulnerable to having their data scraped and personal information compromised.

from Timor Invest https://ift.tt/2MLd0IY

Negative Rates: Coming Soon to a Bank Near You?

At the beginning of the year, the Federal Reserve was expected to hike interest rates at least twice. Instead, it cut rates three times. What should we expect in 2020?

Special: Congress Is After Your IRA, 401(k) and TSP

With numerous analysts and strategists warning about the likelihood of a major stock market crash in 2020, it’s all but guaranteed that the Fed will have to drop rates even further than they already are. But in 2008 the Fed was stymied by the zero lower bound, unwilling to drop interest rates into negative territory.

The Bank of Japan and the European Central Bank saw zero as a challenge rather than a boundary, and boldly pushed their negative interest rates into negative territory. Banks tried to eat the cost of those negative interest rates as long as they could, but eventually they had to pass that cost on to their depositors.

Most banks tried to shield smaller depositors from negative interest rates, confining those negative rates to investors with more than €100,000 in deposits. But a number of German banks have begun charging negative rates to all of their savings account customers. That’s bound to end in disaster.

Negative interest rates disincentivize saving, encouraging depositors to pull their money out of banks. But the more money depositors pull from banks, the weaker the bank gets. Loans have to be called in, assets have to be sold, and the bank shrinks in size. The lower negative interest rates get, the worse that situation becomes.

While this problem is so far confined mostly to Europe, is it only a matter of time before it comes to the US too? With the Fed’s balance sheet already at near record levels over $4 trillion, there isn’t much headroom for the Fed to expand with more quantitative easing. Negative rates may be the only tool the Fed has left at its disposal to combat another stock market crash or financial crisis. Are you prepared for that?

For decades ordinary Americans have treated their money in the bank as though it’s absolutely safe. But what will they do when putting money in the bank ends up actively losing them money each and every day?

Special: IRA, 401(k) & TSP Scam

If you’re worried about your savings withering away due to negative interest rates, it’s time to invest in assets that can bring you a positive return. One of the best of those is gold, which holds its value against inflation better than any other asset. Over the past 20 years gold has far outperformed stock markets, and unlike money sitting in a bank, it won’t lose value with negative interest rates. So if you want to protect your assets against the onslaught of negative interest rates, look to investing in gold for the protection you need.

from Timor Invest https://ift.tt/2MM2xwX

3 Must-Own Stocks for the New Drone Economy

Investor Insights:

- The drone delivery and logistics market is currently about $5 billion in size.

- It’s destined to grow to nearly $30 billion by 2027.

- New proposed federal regulations are a huge first step in that direction.

While you were opening your holiday presents, federal regulators gave a big one to investors.

The Federal Aviation Administration (FAA) announced it wants nearly all drones to broadcast their own “remote ID.”

Presuming the agency gets its way, unmanned craft heavier than half a pound will be required to broadcast their own identifier codes — the same way commercial jets do.

Why is that a big deal for investors?

As I’ve noted in recent months, the drone delivery and logistics market is currently about $5 billion in size — but destined to grow to nearly $30 billion by 2027.

And the key to that growth is creating the equivalent of an air traffic control system for drones.

The new proposed FAA regulations are a huge first step in that direction.

As the agency itself notes, drone remote identification will “lay the foundation for more complex operations” such as drone deliveries, while creating “a traffic management ecosystem for [drone] flights separate from, but complementary to, the air traffic management system.”

As I’ve pointed out before, regular air traffic radars can’t “see” drones. They’re too small.

Which brings me to your first big investment opportunity for the drone economy…

The Next Big Step for Drones

I expect the FAA, as a next step in coming months, to propose regulations that encourage the deployment of next-gen tactical radar systems over most metro areas.

As I’ve noted before, “flat panel” tactical radars (the size of a dinner platter) are already used by the military to monitor battlefield drones. I expect the same technology to be deployed for peaceful purposes in the new drone economy.

Among the leading manufacturers of such systems are Raytheon Co. (NYSE: RTN), Flir Systems Inc. (Nasdaq: FLIR) and Lockheed Martin Corp. (NYSE: LMT).

Flir Systems Is up 83% Since 2016

Tactical radars can be mounted on top of cellphone towers and the sides of tall buildings. Networked together, they form a virtual map of the airspace at rooftop and treetop heights, where commercial delivery drones are most likely to operate.

The First Fortunes in America’s Drone Economy

If all this sounds too boring, think of it this way…

Before Amazon could jump-start e-commerce in 1995, it needed internet browser software first.

Before Apple’s iPhone could revolutionize social media in 2007, faster 4G wireless connection speeds were a necessity.

Before Netflix could change our video viewing habits, cloud storage had to come first.

The first fortunes in America’s drone economy will be made the same way — by building the infrastructure that today’s tech biggies and hundreds of startups will use in the new era.

It’s a trend I’ve been positioning readers of my Total Wealth Insider service to profit from since 2018.

While we’ve already locked in gains of 46% on Kratos Defense & Security Solutions Inc. (Nasdaq: KTOS), there are many other opportunities on my radar. Click here to learn more.

Best of Good Buys,

Editor, Total Wealth Insider

P.S. One company is expected to control the flow of 5G wireless data for a quarter of the globe. If that happens, soon every Netflix movie … every YouTube video … and every Amazon purchase that’s streamed will pass through its networks. At the moment, very few people outside of Wall Street are aware this stock even exists. But it won’t remain a secret for long. For more info, click here now.

from Timor Invest https://ift.tt/36gyUeX

4 Stocks to Buy Before the Ball Drops

Great Stuff Picks: The “Simply the Best” Edition

By this point, everyone and their mother has offered up an opinion on the best stocks to own for 2020.

Everyone, that is, except Great Stuff…

Well, the wait is finally over. Today, I reveal the four stocks that you must own for 2020 and beyond. This was no small undertaking. No sir.

The companies we selected had to have strong financials and equally exceptional stock performance. And, above all, these companies simply had to be part of a critical market mega trend.

Today’s Great Stuff picks play a major role in at least one (if not more) of the six mega trends I laid out yesterday:

- The Internet of Things (IoT).

- Blockchain.

- Artificial intelligence (AI).

- Precision medicine (aka biotechnology).

- Millennials.

- New energy technology.

Am I stealing a bit from Bold Profits here? Maybe. Or maybe I’ve just been in the stock market long enough to recognize a good investment when I see one. (I’ve been doing this for more than 15 years at this point. Give me some credit here … jeez.)

So, without any further ado, here are Great Stuff’s best of the best for 2020 and beyond:

No. 4: Applied Investing

The IoT is big. Really big. You just won’t believe how vastly, hugely, mind-bogglingly big the IoT is. Statista reports the IoT market will reach $1.6 trillion by 2025. And you may think it’s big now, but that’s just peanuts compared to where it’s going once 5G hits its stride.

But the IoT and 5G technologies don’t just fall out of the sky. Someone has to make the devices and the brains that drive those devices.

Who’s gonna do it? You? You, Lt. Weinberg?

Applied Materials Inc. (Nasdaq: AMAT) has a greater responsibility than you could possibly fathom. (Yes, I’m mixing pop culture references at this point … just go with it.) This company builds the machines that make semiconductors and integrated circuits for the IoT and 5G to run on.

Its customers are a veritable who’s who of the hottest smartphone, semiconductor and networking firms on the planet, including Apple Inc. (Nasdaq: AAPL), Nvidia Corp. (Nasdaq: NVDA) and Intel Corp. (Nasdaq: INTC) … just to name a few.

Mega trend established. But what about the money?

Applied Materials beat Wall Street’s estimates in each of the past four quarters. Most recently, the company lifted guidance for the first part of 2020, citing improving industrywide demand. That little trade deal between the U.S. and China certainly helps a lot.

As for AMAT’s price action, the shares are up 90% in 2019, and they’re poised to break out above a double-top from their 2018 all-time highs.

And the icing on the cake? Applied Materials’ current dividend yield sits at 1.37%. That’s better than Apple or Microsoft Corp. (Nasdaq: MSFT).

All of this together is more than enough to put Applied Materials on Great Stuff’s top picks for 2020 and beyond.

No. 3: This Brand Ain’t No Con

When we look back at 2019, we’ll see it as the year of disappointing initial public offerings (IPOs).

From Uber Technologies Inc. (NYSE: UBER) to Lyft Inc. (Nasdaq: LYFT) to Peloton Interactive Inc. (Nasdaq: PTON), nearly every overhyped IPO is now trading underwater. That is, except Beyond Meat Inc. (Nasdaq: BYND).

But even the meatless wonder is living on borrowed time. The IPO fad is over. The real work begins now. It’s time for Conagra Brands Inc. (NYSE: CAG).

Conagra is putting its full weight behind the meat-alternative movement. Given the company’s connections, distribution chain and sheer amount of money, Beyond Meat is in trouble.

Conagra moving into meat alternatives means lower prices at the supermarket for the same expensive products that Beyond Meat pushes. Conagra has more money and broader reach. It’ll dominate the supermarkets in the meat-alternative market.

What … you still think meatless meat is a fad? Don’t kid yourself. There are health reasons. There are environmental reasons. There are sustainability reasons. There are personal preference reasons.

You may not understand them. You may not agree with them. But there are so many varied reasons why this meatless genie isn’t going back in the bottle, even stodgy old Conagra is jumping into the game.

In fact, the company’s shift into fake meat helped lead it to its first revenue beat in two and a half years. Driven by its “on-trend innovation,” Conagra is expected to see revenue rise more than 12% next year — that’s far above the average for its competitors.

And, for those buy-and-hold investors out there (I know you’re still there despite media reports of your death), Conagra sports a tasty dividend yield of 2.52%.

Conagra is poised to become Beyond Meat’s worst nightmare. That alone is enough to make it a Great Stuff pick for 2020 and beyond.

No. 2: The Year of the Mouse

Admit it. You knew The Walt Disney Co. (NYSE: DIS) was going to be on this list, didn’t you?

Honestly, I’ve written … about … Disney so much, what’s left to say?

How about the fact that Disney accounted for 33% of the total U.S. movie market in 2019? Or that seven of the eight biggest-grossing films of 2019 were all Disney? (The other film in that list was Spider-Man: Far From Home, which had some help from Disney’s Marvel Studios as well.)

And then there’s the fact that The Mandalorian was the hottest streaming TV show for the past two months.

Speaking of Disney+, the service is expected to have more than 20 million subscribers by the end of 2019. Combine those subs with Hulu (remember Hulu?), and Disney is a major force in the online streaming market. This is the competition that Netflix Inc. (Nasdaq: NFLX) bears warned you about.

Unfortunately for Netflix, Disney has deeper pockets and better content (i.e., intellectual property), such as Marvel, Star Wars and literally everything it has ever made in its 96 years of existence.

Cable TV is out. Streaming is the new hotness … the next big mega trend in content delivery and production. Nobody does either better than Disney right now.

2020 is the year of the mouse, making Walt Disney a Great Stuff pick for infinity and beyond. (OK, maybe not infinity, but I couldn’t resist.)

No. 1: Oh, Hello Roku!

So, who didn’t see this coming?

If there’s one company that I’ve written about more than Disney this past year, it’s Roku Inc. (Nasdaq: ROKU) … and for good reason.

We’ve long since established that streaming is the hottest mega trend in entertainment.

Every analyst worth their salt is scrambling to crown “the next Netflix.” But many of those same analysts forget that even Netflix wouldn’t be “the next Netflix” without Roku, the handy USB stick that I take from TV to TV to watch The Mandalorian in peace.

In fact, the video-streaming mega trend itself would’ve taken a lot longer to materialize without Roku as a catalyst. Practically every Roku ever made has a Netflix button on the remote. (I’m betting new ones will have a Disney+ button on them soon.)

The point is, Roku is the king of the streaming mega trend. Its low-cost devices enabled millions to stream directly to their TVs at a time when such a thing was left to the geeks of the world. Now, these streaming devices are everywhere. Roku’s software is even embedded into smart TVs to make the process even easier.

The key to Roku’s success is its agnosticism. The company doesn’t care whether you watch Netflix or Disney+, as long as you use a Roku to do so.

In an age where Apple, Amazon.com Inc. (Nasdaq: AMZN) and Google’s parent, Alphabet Inc. (Nasdaq: GOOGL), have frequent spats about which streaming services are available on their devices, Roku is accorded neutral territory.

But device sales are just the tip of the iceberg. Roku has its own streaming channel with a premium option. What’s more, the company makes bank by selling ads on its eponymous streaming channel, in the Roku device menu and in the screensaver.

This is where many analysts miss the boat on Roku. They see it merely as another streaming device, completely missing the ad revenue component — or grossly underrating it. Right now, ad companies spend big on cable TV advertising.

Where will that money go when cable finally kicks the bucket?

I’ll tell you where … it’s going to the streaming market. And right now, Roku has the best bang for an advertiser’s buck. There are roughly 32.3 million Roku device users in the U.S. And every one of those devices has all the streaming services anyone could want. In other words, ad revenue will explode for Roku in 2020.

I’ve said it before, and I’ll say it again: Roku is going to $200 next year. This is the company to invest in for the streaming mega trend, and it’s Great Stuff’s top selection for 2020 and beyond.

Great Stuff: Ring in the New Year, Great Stuff Style!

Say, do you have any snacks? Beer? Bourbon?

All that writing really wore me out.

No? I guess you’re saving up for tonight’s New Year’s Eve bash.

We here at Great Stuff want to thank you for reading and all your feedback over the months. I know I talk a big game, but it’s all for you, dear reader. You’re the reason Great Stuff exists.

Anyway … heading into 2020, Great Stuff promises to keep you informed on the hottest trends on Wall Street, providing you with key information to make you filthy rich (your results may vary) and sparking the best in dinner table conversation.

No, Uncle Jeb, you drank all the Natty Lite, and I’m not making a run to the store for more. If only you had a self-driving Tesla or something…

At this point, Great Stuff would like to remind you that the best investment of all (to even see 2020) is an Uber (or Lyft) home tonight. As always, don’t drink and drive. This has been your Great Stuff PSA for the new year. Thank you.

Finally, Great Stuff is the perfect New Year’s gift for that extra-special someone in your life … someone so special, in fact, that you waited until just now to think about what to get them for the new year.

Show that person just how much you care. Sign them up for Great Stuff today!

Finally, don’t forget to like and follow Great Stuff on Facebook, Twitter and Instagram!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing

from Timor Invest https://ift.tt/2Fc2mqs

Trade of the Decade: Best Way to Profit from 2020’s New Industrial Revolution

With the new year just around the corner, I want to make sure you know about the BIGGEST phenomenon in the 2020 market forecast.

I call it America 2.0.

This new industrial revolution will create opportunities in all of our mega trends.

That’s why investing in America 2.0 is the trade of the decade and could create generational wealth for you and your family … starting now.

Check out this week’s Market Talk to find out the best way to profit from this lollapalooza:

The Internet of Things is about to go to the next level in America 2.0. I’m constantly watching for the latest news and updates as this revolution unfolds. You can follow it all with me on Twitter @MampillyGuru.

First of all, I want to wish all of you a happy new year and a profitable 2020. It’s the beginning of a new decade and I believe the next 10 years will be filled with opportunity and prosperity!

Comment below and let us know what you’ve experienced in 2019 and what you’re looking most forward to in 2020. What am I most exited about? Well of course, I’m looking forward to the coming of the remaking of America. Mt 2020 market forecast is optimistic.

America 2.0

America 2.0 is what I call the coming cultural, technological and economical shift. This is what I am most excited about: it’s an investment strategy for 2020 that I will be discussing often. In many ways, America 2.0 is really what I have been calling a Lollapalooza Effect.

America 2.0 is what I call the coming cultural, technological and economical shift. This is what I am most excited about: it’s an investment strategy for 2020 that I will be discussing often. In many ways, America 2.0 is really what I have been calling a Lollapalooza Effect.

The full picture or final result of the America 2.0 revolution / Lollapalooza Effect is still far from realized. But we are getting there. The first wave of this revolution has long since begun.

Examples of America 2.0

Many people today have smart thermostats, some folks have Teslas that can drive and park themselves. Others are implementing smaller things like smart switches. Just imagine, this is happening everywhere. In homes and at work in many places.

This inter-connectivity has been labelled the Internet of Things (IoT) and it’s slowly making our lives better, easier, more convenient, more efficient and cheaper.

While each specific component, device or product within the IoT seems small, together as a whole, these devices can change the world. It starts at home and where you put all these IoT devices together and use it as a family, then as a town, then as a state, as a country, as a nation, as an economy, it is going to start to show a big impact in the way we count our economics and finances.

I believe we are going to see rising growth, rising productivity and rising use of all the megatrends that I and my team of stock analysts have been talking about for nearly four years through Profits Unlimited and all our services.

2020 Warning: Don’t Listen to Sensational Media

I know there are many people out there that focus on the negative and fear of the future to get ‘clicks’— I read MarketWatch, Yahoo! Finance and the Wall Street Journal. The financial media that I sometimes refer to as the bad news media is making some pretty bold claims. It often does seem that they focus almost exclusively on bad news.

I know there are many people out there that focus on the negative and fear of the future to get ‘clicks’— I read MarketWatch, Yahoo! Finance and the Wall Street Journal. The financial media that I sometimes refer to as the bad news media is making some pretty bold claims. It often does seem that they focus almost exclusively on bad news.

Every projection they issue claims something is going wrong or something is about to go wrong I would tell you that they have a bias and a prejudice: they focus on bad news for any number of reasons.

The only good news they largely focus on is on the day when something is released.

There’s no reason for us to get into that but I do want you to be careful about where you get your investing news. Find balanced reporting.

My 2020 Market Forecast

With respect to the overall market in 2020, I’m still optimistic.

With respect to the overall market in 2020, I’m still optimistic.

I can tell you there is a ton of good news to report on right now and the outlook for the economy in 2020 is good.

In housing, the millennial generation is out there buying which in turn is stimulating an enormous amount of spending. The Internet of Things is blossoming in every aspect of our life and becoming more integrated into our daily lives.

Big data, which is all the data we collect as a result of having these smart sensors on our devices, the primary focus of IoT, is collected and stored, which will inform future artificial intelligence (AI). It makes our lives cheaper, easier and more efficient. These are just 3 examples of my optimistic 2020 market forecast.

Not to mention solar power, new energy, transportation — you can go across every megatrend and they are increasingly being put into our economy. That makes me more optimistic because it means we will get more growth for less money. These technologies actually work and they are interconnected. America 2.0 is going to be an incredible thing to behold.

America 2.0 will be efficient, optimal and cost less than the old way. I’m optimistic for what I believe is going to unfold in 2020. It’s going to be a continuation of many of the things that have worked for the past three-and-a-half years in the time that we started Profits Unlimited. However, I have to say that no one should expect a straight line.

Ups & Downs Are Natural

Remember what happened in 2018? There was a panic. People thought for any number of reasons that there was going to be a crisis, a crash, a recession — who knows. They started to sell stocks. As they did that, they pushed prices down.

Toward the end of 2019 as no crash has happened, no crisis, no recession, they have come back — as we told you they would — with all that money and they have pushed stocks up. There’s always a back and forth motion for the stock market. This is why we have the Rules of the Game for our services. We recommend all our premium subscribers follow those rules closely.

Generally, I want to say again that my 2020 market forecast is optimistic. I believe higher prices are coming which means bigger gains in your portfolio. Please stay in the stocks we recommend. If you’re considering going into it, please check out our services. Start investing in 2020 with the expertise of Wall Street pros and analysts that I have on my team.

Comment below and tell us about your experience investing over the last decade and what you are looking forward to most in 2020.

Regards,

Editor, Profits Unlimited

from Timor Invest https://ift.tt/2MG58s7

2020 Will Be the Year for Silver Stocks — How to Double Your Money

Story Highlights

- Central banks bought a record amount of gold this year.

- Now, another precious metal must rise by 35% to get back to its average price.

- Here’s an easy way to turn that gain into 105% without using options.

According to the World Gold Council, central banks bought a record $15.7 billion of gold in the first half of 2019. And that trend continues today.

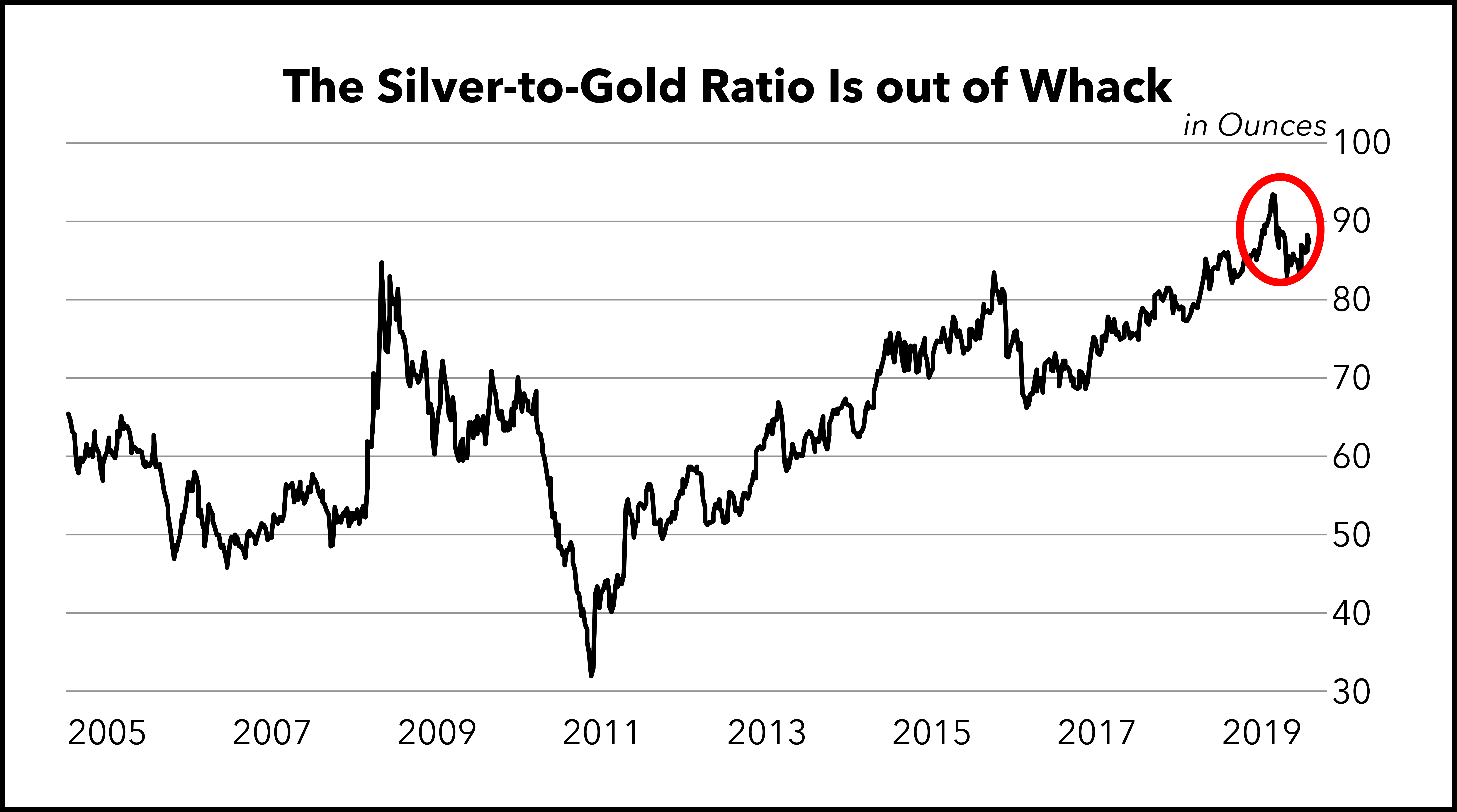

That buying spree led to the biggest imbalance between gold and silver that I’ve seen in my career.

I’ve watched the prices of gold and silver orbit one another for nearly 15 years now. And rarely do they get this far out of balance. It took serious bank involvement to get there.

Central banks, the big national banks around the world, are worried. And when they are worried, they buy gold. That’s what pushed the gold price up from around $1,200 per ounce in late 2018 to over $1,525 per ounce in August 2019.

That’s an increase of 27%. Central banks helped to drive the largest 12-month increase in gold prices since 2011.

Now, one metal needs to rise 35% just to get back to its average price. That’s a huge move — one that we could turn into an easy 105% when it happens. Because it will happen, likely in early 2020.

Let me show you why…

Do you own any metal, (not miners)?

— Matt Badiali (@MattBadialiGuru) December 26, 2019

How We Measure Gold and Silver’s Relationship

The relationship between the gold price and the silver price is one of the first relationships I studied when I began working in finance.

It’s important because these metals are a safe haven for many skilled investors.

Gold and silver move together like the earth and the moon. Both hold value in their own right.

Gold is scarcer and more desirable than silver, so it costs more.

We use the gold-to-silver ratio to measure that relationship.

In other words, we measure how many ounces of silver it takes to buy an ounce of gold.

In July, I told you that the ratio was at a 30-year extreme. It took 92.6 ounces of silver to buy an ounce of gold.

We had to go all the way back to 1993 to find a time when the ratio was more out of whack. That’s why I told you to buy silver in July.

By September 2019, the trades in silver gained 56% in just over two months. But I knew bigger gains were ahead.

I was right. The trade on VelocityShares 3x Long Silver exchange-traded note (Nasdaq: USLV) skyrocketed from $63 to $132 by early September — a fantastic 110% gain!

The iShares Silver Trust exchange-traded fund (NYSE: SLV) trade returned 29% over the same period.

Those were great trades.

After that, shares of both eased lower. But the gold-to-silver ratio didn’t. That creates another great opportunity today!

Silver Price Needs to Rise 35% — Here’s Why

As you can see from the chart below, the ratio is at an extreme:

Data From Bloomberg.

Since 2005, the average is 65 ounces of silver to 1 ounce of gold. Right now, the value is 87-to-1.

That’s way, way out of balance.

In order to get back to 65-to-1, one of two things must happen.

- The silver price must go up 35%, to $23 per ounce.

- The gold price must fall 26%, back to $1,090 per ounce.

I don’t think we’ll see gold fall this year. It would take a big seller, and we know central banks are still buying. So there won’t be enough selling to offset that much demand.

Instead, I think 2020 will be the year of a massive silver rally.

If you haven’t already bought the iShares Silver Trust ETF (NYSE: SLV), which tracks the price of silver, now is the time to consider adding it to your portfolio.

Or, for a bigger payoff, look at the VelocityShares 3x Long Silver ETN (Nasdaq: USLV). This leveraged fund would return about 105% on a 35% rally in the price of silver! The risk-reward on this trade looks excellent.

If you’re looking to buy the best silver stocks, in my Real Wealth Strategist newsletter, we’ve held two great silver miners in our model portfolio since March. My readers’ open gains on those positions are 70% and 19% at last glance.

And I’m researching new silver companies to add in 2020, so we can profit when the metal’s price rises 35%!

To learn more, check out this special presentation today.

Good investing,

Editor, Real Wealth Strategist

P.S. For daily commentary, pictures and ideas — not to mention my brand-new weekly Twitter polls! — follow me @MattBadialiGuru on Twitter and Instagram.

from Timor Invest https://ift.tt/2ZLtQwQ

понедельник, 30 декабря 2019 г.

2 Small-Cap Gold Stocks That Could Double in 2020

Gold is widely considered to be one of the best opportunities for investors going into 2020, as many of the reasons for gold’s price to appreciate are present. This has already caused a major increase in the price of the precious metal in 2019 and, consequently, a number of the mining companies, too.

Some of the most widely known gold-producing majors have led the way, while some of the lesser-known companies have lagged behind.

This has created a major opportunity for investors, especially if you are willing to take more of a risk and invest in turnaround companies or those with high margins in areas of the world with political uncertainty.

Two promising lesser-known gold stocks that present some of the best opportunities going into 2020 are Argonaut Gold (TSX:AR) and Roxgold (TSX:ROXG).

Argonaut Gold

Argonaut Gold is a small-cap miner that will do roughly 200,000 ounces of production this year. It has five total mines: three in the exploration and development phase and two that are already producing. One of the exploration mines is located in Canada with the other four in Mexico.

The company has been focusing on maintaining production levels while reducing its operating costs and capital expenditures in order to increase its free cash flow.

The lower costs and increased cash flow will help to fund Argonaut’s expansion and bring new mines online, which are expected to have lower costs themselves.

This will lower Argonaut’s overall consolidated costs per ounce that it produces and help to drive better margins and more profit.

It has roughly $650 million in development assets today, but estimates that every $100 increase in the price of gold increases its development assets by roughly $140 million.

The stock is also extremely cheap both from a metrics’ point of view and compared to a number of its peers in the industry.

Its price to net asset value is just 0.5 times, and its price to 2019 estimated cash flow of just 3.1 times — both extremely low and some of the lowest in the industry.

Going forward, its number one priority is to lower costs, but Argonaut is also focused on de-risking its exploration mines and improving its balance sheet.

Roxgold

Roxgold is also a small-cap company; it’s estimating it will do roughly 150,000 ounces of production in 2019. The company has two mines that it operates, both located in West Africa, one in Burkina Faso and the other in Cote d’Ivoire.

The locations pose some risk due to the political uncertainty in that region of the world; however, it also exposes the company to very cheap production, which gives it an impressive operating margin. It’s all-in sales costs are extremely cheap at just $795, giving it major profit margins, especially with gold selling for around $1,500.

In the first nine months of 2019, its cash flow from mining operations was $68 million, or $0.18 a share. On an annualized basis, that would be $0.24 a share, giving it a current price to operating cash flow of just four times.

It continues to focus on keeping its costs low going into 2020, as its estimated sustaining capital is just $30-$35 million with roughly $10 million of exploration capital expenditures.

It’s been taking major advantage of the increased gold prices. In the third quarter of 2019, it sold 9% more volume of gold than in the third quarter of 2018, yet its revenue increased by 32% and its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) grew by 44%.

This is all thanks to a 23% increase in its average realized gold price sold, which was $1,481 in the third quarter of 2019 versus $1,207 in the same quarter last year.

Bottom line

With the gold price likely to continue increasing over the next few years, both these stocks offer impressive opportunities for investors to go gain some leveraged exposure.

There is more opportunity with Argonaut, but some of that is dependent on its execution of its transformation plans. Roxgold isn’t as undervalued, but it already has low-cost operations and strong margins, so any increase to the price of gold is essentially pure profit.

Fool contributor Daniel Da Costa has no position in any of the stocks mentioned.

from Timor Invest https://ift.tt/2F5SQ8z

Double Your Money: This 1 Stock Has the Best Chance to Gain 100% or More in 2020

Going into 2020, financial markets have been on a strong run, and in both Canada and the U.S., markets are at or near all-time highs. While 2019 was a great year for the markets, the question of what will happen in 2020 looms large.

Many investors believe that a recession– or at least a fairly sized correction in financial markets to bring valuations back down slightly — is imminent. Which stocks are likely to perform the best in these uncertain conditions?

As many investors may already know, it’s likely that gold will be a top asset in the coming year, as more investors seek the safety of the asset and hedge their portfolio’s against potential monetary stimulus down the line.

In 2019, the price of gold increased by roughly 17% — a significant move for the precious metal — and 2020 could see more of the same.

Silver, which tends to follow the price of gold and is more volatile, was up only 14% in 2019 — still significant but clearly underperforming gold.

In addition, the silver market has been in a major deficit the last five years, and with industrial demand for silver continuously growing, the fundamentals are pointing to the likelihood of a major rally coming soon.

This leaves a big opportunities for investors who want to gain good exposure to silver, and one of the top companies to invest in in the silver mining space is First Majestic Silver (TSX:FR)(NYSE:AG).

First Majestic is one of the leading silver miners in the world. It operates exclusively in Mexico through its four producing mines and has the largest portion of its revenues derived from silver out of all its peers.

The company is well positioned to take advantage of a run up in silver’s price and has a good possibility of doubling its share price in 2020 as a result.

The stock has grown at exceptional rates before, jumping 475% from August 2010 to April 2011, when the price of silver increased from $18 an ounce up to $46 an ounce — an 155% increase.

Now, as the price of silver is on the verge of another breakout, this opportunity exists again.

In the third quarter of 2019, First Majestic had an 8.8% net margin compared to the same quarter last year, where its net margin was just 6.6%. Its revenue increased by 9.5%, while its net income increased by 45%, showing the scale that First Majestic has and the profits it’s capable of realizing as the price for silver grows.

In total, the price of silver is up between 15% and 20% in the third quarter of 2019. This means that due to First Majestic’s strong operations and leverage to the price of silver, another 25% jump in the underlying metal would increase its net income by roughly 75%, with all else being equal.

Plus, First Majestic could improve that by even more if it executes its plans to increase silver as a percentage of its total revenue from roughly 58% in 2019 to approximately 67% in 2020.

Looking at the silver market as a whole and its underlying fundamentals, and looking at First Majestic’s top-notch operations and position in the industry, it’s clear the stock is trading well undervalued and offers investors a major opportunity to double their money or more in 2020.

Allocating a small amount of your portfolio to silver exposure would be prudent going into the new year to offer your portfolio some protection while also exposing you to a major upside opportunity.

5 TSX Stocks for Building Wealth After 50

BRAND NEW! For a limited time, The Motley Fool Canada is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50.

So if you’re looking to get your finances on track and you’re in or near retirement – we’ve got you covered!

You’re invited. Simply click the link below to discover all 5 shares we’re expressly recommending for INVESTORS 50 and OVER. To scoop up your FREE copy, simply click the link below right now. But you will want to hurry – this free report is available for a brief time only.

Fool contributor Daniel Da Costa has no position in any of the stocks mentioned.

from Timor Invest https://ift.tt/2QbE5az

The Biggest Crypto Winners and Losers of 2019

Even though the cryptocurrency industry is not new to ups and downs, 2019 has turned out to be the year with the most surprising reveals. The long-lasting bear market of 2018 moved market analysts to call it the year of regulatory reckoning, leaving many jurisdictions uncertain about how to treat cryptocurrencies.

However, 2019 also turned out to be the year of the comeback, as big tech giants like Facebook moved from banning crypto to embracing it.

Escalating global events such as the trade war between the United States and China have shifted investors’ point of view on the utility of cryptocurrencies like Bitcoin, but there is still a lot to be done even as the U.S. Securities and Exchange Commission continues to turn down every other Bitcoin ETF proposal.

As the year comes to a close, here is a look at the companies, individuals and various crypto projects that managed to come out on top in 2019, as well as those that failed to mark the year as a positive in their books.

The winners

Bitcoin’s double growth

This year, Bitcoin and the entire blockchain and cryptocurrency industry celebrated its tenth anniversary as proof of the resilience of Satoshi Nakamoto’s creation. However, at the beginning of 2019, the cryptocurrency industry was just recovering from the so-called crypto winter of 2018.

Fortunately, Bitcoin kicked off the year with a bullish trend that resulted in an approximate price increase of 11% higher by the end of the first quarter. Anthony Pompliano, the co-founder of Morgan Creek Digital asset management firm, shared his view with Cointelegraph:

“Bitcoin’s price is up significantly in 2019 [as there are] more buyers than sellers on a net basis this year.”

As the trading volume and market capitalization increased throughout the second quarter of the year, Bitcoin led the market with a 165% gain as its price surged from $4,103 to $10,888. Furthermore, Bitcoin’s market dominance increased from 54.6% to 65%.

Among the reasons that have promoted Bitcoin’s continued growth despite a struggling market is the view that the digital currency can act as a hedge in the wake of increasing global uncertainty. This year, the U.S.–China trade war saw most investors look to Bitcoin and gold as hedges. Pompliano also told Cointelegraph that there were other contributing factors:

“The biggest moments probably revolve around the announcement of Libra and the subsequent reactions, both positive and negative, from various folks across the traditional and cryptocurrency markets.”

However, it was not all sunshine for Bitcoin in 2019. Over the third quarter of the year, a bearish outlook emerged as Bitcoin’s price decreased significantly as 100 billion in market capitalization was lost. Fortunately, even as the market struggled to gain ground against the bears, Bitcoin not only closed the quarter with the least amount of loss but also increased its market dominance by 5.4%. Ultimately, of all cryptocurrencies, Bitcoin’s performance has been the best so far.

Compared to assets from other markets, Bitcoin’s performance throughout the year is still far from tenuous. For instance, even though gold is regarded as a reliable store of value, its price has only increased by 17% since January. Even the S&P 500 Index, although with an excellent performance of +21%, is still dwarfed by Bitcoin’s growth throughout the year. Beyond price, Bobby Lee, CEO of the Ballet crypto wallet, told Cointelegraph that Bitcoin has benefited from several major technological developments:

“2019 was a great year for Bitcoin bulls because of the advances in the open-source ecosystem. Lightning Network is increasing Bitcoin’s transaction capacity, wallets with built-in, user-friendly features (Wasabi, Samourai) are improving privacy.”

Gods Unchained’s rise to popularity

According to reports, Gods Unchained, a blockchain-based virtual card game built on Ethereum, emerged as one of the highest-grossing and most popular blockchain games in 2019. This came about after the platform completely sold out its Genesis Card Pack to the tune of about $6.2 million. This came about after Blizzard, the creators of Hearthstone (a digital trading card game) banned Hearthstone player Chung Ng Wai (also known as Blitzchung) for expressing support for the Hong Kong protests. The Hearthstone game developer also stripped Blitzchung of his winnings.

In addition to the backlash received from the gaming community, Blizzard’s actions were criticized in a tweet by Gods Unchained that claimed Blizzard “care[s] about money more than freedom.” Gods Unchained also promised to compensate Blitzchung for his lost winnings while offering him an invitation to their $500,000 tournament.

Related: Blizzard Bans Hearthstone Player, Blockchain Comes to Rescue

The tweet by Gods Unchained was retweeted over 10,000 times, and Google searches for the game have since surged. Unlike Hearthstone, Gods Unchained is decentralized and uses blockchain to ensure that players truly own in-game items and have the freedom to trade them at will.

In a move to give online game players long-term incentives, James Ferguson, CEO of Gods Unchained said that the game is “leveling up the outdated practices of the gaming industry.”

Coinbase’s continued expansion

In the past, Coinbase maintained a reputation for employing a rather selective strategy for adding coins to its exchange. As one of the big league exchanges in the crypto space, Coinbase is also known for having significantly fewer large-scale hacks. In a year that saw other major exchanges like Binance fall victim to large scale security breaches, leading to the loss of thousands of Bitcoin, Coinbase stands out as a reliable and safe platform.

However, the company was heavily scrutinized by Twitter users this year over its acquisition of Neutrino, a startup that collects cryptocurrency transactional data using the blockchain. For most Twitter users, this move seems to facilitate the exchange’s spying on its customers.

However, Coinbase’s move to acquire Neutrino is, according to a Coinbase blog post, part of its goal to support all assets while complying with applicable laws. In addition to acquiring Neutrino, Coinbase has doubled the number of listed cryptocurrencies on its exchange since 2018. Coinbase’s aggressive listing approach has seen the addition of coins such as Dash, Cosmos and Waves, to mention just a few.

The company has almost constantly been making news throughout the year, from making acquisitions to denying them, as well as securing multiple patents along the way. Meanwhile, Coinbases’s Visa debit card solution has also seen exponential growth this year, now available for use in even more countries.

In May 2019, the company also expanded its reach to more than 100 countries while making its USDC stable coin — previously only available in the U.S. — available in 85 of those supported countries. In comparison, Coinbase was only available in about 32 countries last year. Its aggressive expansion appears to be in direct competition to other global players like Binance.

Binance ventures further

Ask any market analyst and they will admit that initial exchange offerings have grown into a big business in 2019. Reports have revealed a high demand for IEOs right from Q1 2019 to Q3, not to mention the fact that they collectively raised over $1.5 billion in the first half of 2019 alone. Unlike initial coin offerings, the biggest determining factor for a successful IEO is the availability of liquidity, and what better way to access liquidity than launching an IEO on a popular exchange.

That is why Binance and its native cryptocurrency BNB have had one of the best years yet. As one of the biggest marketplaces for digital assets, Binance enjoys a significant share of the trading volume. The exchange’s performance has been so exceptional that the Binance Coin has gained value by 150% over the year. When taking everything into account and considering year-on-year growth, Binance Coin has even slightly outperformed Bitcoin.

Also, Binance expanded its reach with the launch of a fully independent U.S. arm of its trading platform. Despite heavy regulatory pressure that keeps the Binance exchange in the U.S. from operating in states such as New York, the company’s partnership with BAM, a registered money service in the U.S., has so far given the exchange some leeway.

The losers

Facebook’s uncertain Libra launch in 2020

Facebook’s announcement of its Libra cryptocurrency has been one of the major events of 2019. However, on the unveiling of Libra as a stablecoin backed by a select number of national currencies, U.S. lawmakers reacted with skepticism, summoning Facebook CEO Mark Zuckerberg to multiple hearings.

Related: What Is Libra? Breaking Down Facebook’s New Digital Currency

At its core, Libra is a stablecoin backed by real money and lets users buy, sell and send money at nearly zero fees across borders. According to the project’s white paper, Libra’s overall mission is “to enable a simple global currency and financial infrastructure that empowers millions of people.”

Libra’s white paper further claims that it will use “a new decentralized blockchain, a low volatility cryptocurrency, and a smart contract platform” to empower about 1.7 billion unbanked people. This will be achieved through the use of Facebook’s WhatsApp, Messenger and Calibra, which is a digital wallet designed for Libra users.

Despite Libra’s ambitious plan to empower the unbanked, the Libra project has not only come under heavy scrutiny from lawmakers but also faced internal problems of its own. While sharing his thoughts with Cointelegraph, Ballet wallet’s Lee expressed optimism about Libra, saying that although “legislators and regulators in the United States and Europe understand that non-government currencies are a threat to their power, government opposition will diminish over time.” Lee further explained:

“Governments will change their stance because they will come to understand that they can’t control or stop Bitcoin, and they will prefer to have their citizens use centralized corporate coins that can easily be regulated, monitored, and pegged to fiat currency.”

Despite Libra’s ambitious plan to empower the unbaked, the Libra project has not only come under heavy scrutiny from lawmakers but also faced internal problems of its own.

The U.S. Congress has asked Facebook to pause further development of the Libra projects, and cynics now believe that the project will not get out of the starting blocks without the government’s approval. Multiple European countries have also spoken out against the proposed cryptocurrency, while China announced that it will soon launch its own stablecoin, a national central bank digital currency, likely as a retaliatory measure. Furthermore, in the wake of increased scrutiny from government regulators, some of Libra’s high profile backers like Visa, eBay, MasterCard and PayPal have abandoned the project.

A rocky year for Circle

In October 2018, Circle, a cryptocurrency firm based in Boston and backed by Goldman Sachs teamed up with Coinbase to launch the Centre consortium. Counting on its reputation as one of the most well-funded crypto startups, the two companies aimed to help accelerate adoption of cryptocurrencies. Through the Centre consortium, Coinbase and Circle would increase liquidity to the crypto industry through the issue of a stable coin called the USD Coin.

In July this year, Coinbase and Circle broadened participation into their consortium in a move that will allow other financial entities interested in the project to issue the USD Coin. In the announcement, the Centre network mentioned that “a natural next step is to imagine a new global digital currency” that would include a basket of tokens backed by a variety of stablecoins. Simply put, Centre’s plan is to go with a Facebook-like approach to create a global currency.

However, Circle has had a rocky experience throughout 2019. Even though the USD Coin has received a positive reception, with Centre claiming that the stablecoin has been used to clear on-chain transfers worth over $11 billion, Circle closed its mobile app, reduced its fundraising goal by 40%, and laid off 10% of its staff between May and June this year. Just recently, the company let go of 10 more of its employees, citing efforts to streamline its services.

The latest news of layoffs from Circle comes after the recent transition of the company’s co-founder Sean Neville from his position as CEO to a seat at the company’s board of directors. However, a representative of Circle has denied any connections between the recent layoffs and Sean’s transition, telling Cointelegraph that:

“None of this is related to Sean transitioning out of the co-CEO role. Sean will continue to serve on Circle’s board.”

Craig Wright’s court battles

When Australian-born technologist Craig Wright claimed to be Satoshi Nakamoto back in 2015, most people in the crypto community were skeptical and thought nothing of it.

Most people expected that the Satoshi Nakamoto impersonator would have scurried back into obscurity by now. However, Wright and his claims have continued to headline the news throughout 2019. Wright claims that he invented Bitcoin a decade ago and mined over 1 million BTC along with his late business partner Dave Kleiman. After Kleiman’s death in 2013, Wright claims that he put the mined Bitcoin in the “Tulip Trust.”

However, the Australian entrepreneur and computer scientist was sued by Kleiman’s estate in 2018 for allegedly stealing up to 1 million Bitcoin. In the past, it is said that Wright and Kleiman worked together on mining and developing Bitcoin. According to Kleiman’s family, Wright stole between 550,000 to 1 million Bitcoin — worth about $10 billion.

The ongoing case led to Magistrate Judge Bruce’s ruling that ordered Wright to turn over half of his Bitcoin holdings and intellectual property from before 2014 to Kleiman’s estate, presuming he is indeed Nakamoto. On Oct. 31, the trials re-emerged after Wright pulled out of the settlement agreement to forfeit half his Bitcoin and intellectual property.

In addition to his court battles, Wright was scrutinized by the crypto community after presenting what was considered forged documents as evidence of him being Nakamoto in another case of Wright against Peter McCormack. Wright’s case against McCormack is based on the fact that McCormack’s repeated statement that Wright is not Satoshi is harmful to Wright’s reputation. Most recently, Wright presented another document that allegedly proves how he came up with the Satoshi Nakamoto pseudonym.

Bitcoin ETF’s continual rejection by the SEC

Even though U.S. regulators have always left a window for the possibility of approving Bitcoin exchange-traded funds in the future, up until now, every single attempt to license a Bitcoin ETF has been met with failure. In October this year, an ETF proposal filed by Bitwise Asset Management in conjunction with NYSE Arca was rejected by the Securities and Exchange Commission for failing to meet legal requirements that prevent illicit market manipulation.

In fact, all Bitcoin ETF proposals presented to the SEC have been rejected on concerns about fraudulent activities and market manipulation. One of the main criteria for approving an ETF is establishing the underlying market of a new commodity-based ETF.

Related: The SEC Does Not Want Crypto ETFs — What Will It Take to Get Approval?

If the underlying market is resistant to manipulation, regulators can give the ETF the go-ahead. Given the complexities of the Bitcoin market, it seems approval from the SEC is unlikely. Despite the earlier rejection of Bitwise’s application, the SEC later announced that it would review Bitwise’s proposal once again.

While speaking to Cointelegraph on the realistic timeline of the first Bitcoin ETF approval, Charles Lu, the CEO of the Findora fintech toolkit provider said, “For a Bitcoin ETF proposal to gain SEC approval, the sponsor will need to prove that real price discovery is happening as opposed to market manipulations.” In Lu’s opinion, this will not happen anywhere soon, since the SEC would require “surveillance sharing agreements” with the big exchanges.

2019 and 2020

Overall, the crypto industry has shown some significant growth over the past year. Although volatile, Bitcoin is showing significant signs of growth. More institutional investors are looking into the industry to find more ways to invest as well. Even though there is a downtrend in market cap and trading volumes, prominent traders believe that a turn of fate might just be around the corner, especially for Bitcoin holders.

Out of all the winners and losers of 2019, perhaps Facebook Libra is one that stands to be most impactful in 2020. For most onlookers, it will be interesting to see whether Facebook’s Libra project will turn a new leaf and launch successfully in 2020. If it does, there is a high likelihood that big changes will take place throughout the entire industry.

from Timor Invest https://ift.tt/2tjSGb2

Trying to Make Money in Stock Markets Is Tough For Mom & Pop

Many people look at surging stock markets, and especially hot stocks like Amazon and Netflix, and think that they can make it big investing in stocks. Yet very few investors are actually able to make market-beating stock gains, let alone even match the market. The sooner they understand that, the sooner they’ll be able to make investment decisions that can benefit their bottom line.

Special: IRA/401(k) Alarm: Secret IRS Loophole Will Change Your Life

The annual return for the average investor is less than the average return on the S&P 500. Even those investors who invest in S&P 500 index funds earn less than the index, due to the various fees imposed upon them. That should make it clear that being able to match stock market performance is very difficult if you’re investing in stocks. Many investors try and fail, which is why the average investor performs worse than markets. But that isn’t the only thing holding back Mom & Pop investors.

Ordinary investors just don’t have the ability to engage in the same type of trading as the pros do. They can’t just call up a broker and execute a trade immediately. In many cases they’re investing in stocks through some sort of mutual fund or 401(k) program, meaning that any purchases and sales are happening at the end of the trading day, after all the professionals have made their money.

Now we’re finding out, too, that some trading platforms were disadvantaging ordinary investors even more. Online platform Robinhood, which brought free trades to the masses, was fined by FINRA regulators for failing to ensure that its customers received the best possible prices for their stock orders. The company was executing purchases through broker-dealers that may very well have been mining the purchase information, allowing them to see which stocks were in demand and which therefore would be rising in price, allowing them to get ahead of the inevitable rise in price once purchases were executed.

Unless you’re incredibly talented at stock picking, and incredibly lucky too, the odds of you getting rich through investing in stocks are slim. But many investors think that stocks are their only option. They couldn’t be more wrong.

Many investors may only know gold as a hedge against inflation and financial crisis. Few know that gold is a growth asset in and of itself. Since the gold window closed in 1971, gold has outperformed both the S&P 500 and the Dow Jones Industrial Average. And over the past 20 years, gold has significantly outperformed both of those indexes.

Special: Why 2019 Could Be The End Of Your IRA, 401(k) or TSP

While you can’t go back in time and change your investment decisions from back then, you can still make the decision to invest in gold today. With stock markets at all-time highs to end this year, the consensus for 2020 is that a major correction is in the works. Will you be ready for it by investing in gold?

from Timor Invest https://ift.tt/2Q91oSc

Regifting the Santa Claus Rally; Nio and Tesla Shockers

Wall Street’s White Elephant Party

Santa Claus has been good to the market this year.

Well … at least until today. We’re on day four of the so-called Santa Claus rally — the five-day rally at the end of every year — and investors are “regifting.” By all measures, today is Wall Street’s white elephant party.

What in the world are you talking about, Mr. Great Stuff?

I’m talking about profit-taking. The S&P 500 Index is up a hefty 29% in 2019, putting it less than half a percentage point shy of its best year since 1997.

Records are all fine and dandy, but they mean little if you can’t take some of those profits to the bank. So, why not take some profit off the table?

What’s more, these holiday trading days historically have very low participation. In other words, low volume.

Why does low volume matter?

With fewer market participants, small market moves become exaggerated — both to the upside and to the downside. It’s one of the key drivers behind the Santa Claus rally, after all.

The Takeaway:

What we’re looking at today is a combination of profit-taking and portfolio repositioning. We’re closing out not only a year, but also a decade. Traders of all stripes are positioning themselves for the best possible returns and portfolio performance.

In short, don’t take today’s (or tomorrow’s) market activity too seriously. It’s not an indication of any broader market trend, nor does it give you any hints on where stocks will go in 2020.

What you want to do right now is what everyone else in the market is doing: Position your investments for next year.

Tomorrow, Great Stuff will give you what we believe are the four best stocks to own for 2020 (and beyond).

But for now, we’re going to steal a page out of the Bold Profits team’s playbook by identifying six mega trends that you should already be investing in:

- The Internet of Things (IoT).

- Blockchain.

- Artificial intelligence (AI).

- Precision medicine (aka biotechnology).

- Millennials.

- New energy technology.

These six mega trends are the way of the future … one where everything is digitally connected via the IoT, encrypted with blockchain and driven by AI.

These core technologies will push biotechnology to even greater heights and increase investment in new, more sustainable energy tech. And all of these opportunities ride on the investment dollars and the initiative of the biggest generation since the baby boomers: millennials.

Wall Street’s “white elephant party” today provides you with an excellent opportunity to load up on these mega trends.

Now, I know from your reader feedback that many Great Stuff readers are already on the fast track to investing in these six massive mega trends. Kudos to you!

However, if you’re not sure where to start learning about these trends, now’s your chance to get started with the excellent research that only Paul Mampilly and his Bold Profits team can provide.

Take your first steps into the coming decade’s six biggest mega trends with Paul Mampilly’s Profits Unlimited newsletter.

Click here to find out how to sign up now!

The Good: Shocking Results

Chinese electric vehicle (EV) maker Nio Inc. (NYSE: NIO) is surging today … providing another lesson in the realm of lowered expectations.

The EV maker and Tesla Inc. (Nasdaq: TSLA) rival reported a third-quarter loss of $352.8 million, or $2.38 per share. Despite the loss, revenue jumped 25% year over year to $1.84 billion, as EV deliveries spiked 35% to nearly 5,000 vehicles.

Nio blamed the losses on a soft second half of 2019 due to the removal of Chinese EV subsidies. At this point, that doesn’t matter much. The company only has a reported $274.3 million in cash on hand — well short of what Nio needs to continue operating through the year.

Nio addressed the issue with investors, stating that it’s working to obtain debt financing, but that these projects were “subject to certain uncertainties.”

Certain uncertainties? I’m pretty sure that’s the definition of an oxymoron right there … either that, or Nio is paraphrasing Rush: “He knows changes aren’t permanent, but change is.”

Regardless, Nio’s third-quarter earnings were nowhere near as bad as Wall Street expected. As a result, the stock is up a whopping 69% today.

Lose $352.8 million, rally 69%. How’s that for lowered expectations?

The Bad: Demand Saturation?

Speaking of Chinese EVs, the first Shanghai-built Tesla Model 3 just rolled off the assembly line — much earlier than expected.

Despite the herculean feat Tesla accomplished with its Chinese Gigafactory, Cowen Inc. (Nasdaq: COWN) analyst Jeffrey Osborne lowered his delivery estimates for Tesla this year.

Osborne now believes Tesla will only deliver 356,000 vehicles in 2019, below the company’s stated target of 360,000 to 400,000.

Alongside the lowered estimate, Osborne wrote this to clients:

Wait … demand saturation? Isn’t high demand a good thing? What Osborne is essentially saying here is that there’s nothing new in the EV market to drive additional demand. Anyone who follows Tesla knows that this simply isn’t true. The company constantly updates new models and software features for existing models.

Honestly, it’s a weird statement from Cowen … especially since it raised its fourth-quarter delivery estimates in the same … exact … note to clients. If you’re bearish on Tesla, be bearish. There are plenty of reasons out there. But demand saturation isn’t one of them.

The Ugly: You Had 1 Job!

Up until December, you basically had two options for buying tickets to literally any event: Ticketmaster and Live Nation Entertainment Inc. (NYSE: LYV). However, the U.S. Department of Justice (DOJ) approved the merger between these two earlier this month. And now there’s just one source for tickets.

Oh sure, the DOJ is asking federal courts to keep harsh competition conditions in place for longer than they had originally agreed to. The rules are designed to keep Live Nation and Ticketmaster from punishing venues that use other ticket vendors.

But — and this is the good part — the DOJ is asking for the extension of these harsher conditions because Ticketmaster broke them in the past.

So, clearly, the rules worked, and a Ticketmaster/Live Nation tie-up will be a wholesome and not-at-all-exploitative company from which to buy event tickets.

And if you believe that … I’ve got some oceanfront property in Arizona to sell you.

This week, Live Nation CEO Michael Rapino and President Joe Berchtold said that concert tickets were an “incredible bargain” and a “huge opportunity for our bottom line.” In other words, those $100+ tickets you bought this year were a steal!

Prices are going up, and Live Nation will reap the benefits … not your favorite artist, and certainly not your wallet.

DOJ, you had one job. One. Job. And you failed.

Wait … I’m not done yet with this whole Live Nation BS.

I see a fair amount of concerts per year — probably more than the average. With my kids getting old enough to enjoy concerts now, my costs are going up anyway. There are few joys in this world better than watching my kids enjoy a concert — especially since their music tastes line up with mine so well.

In the absence of the Live Nation monopoly (let’s be honest and call it what it is), ticket prices for top-100 tour tickets in the U.S. have risen 250% since 1996. The chart below shows how prices have risen 20% in just the past five years:

“The vast majority of shows are very reasonably priced for fans,” Berchtold told MarketWatch. Mr. Berchtold reportedly makes more than $4 million per year in salary and bonuses.

I don’t think his version of “reasonably priced” is the same as my version of “reasonably priced.”

Great Stuff: Happy New Year!

Are you ready for all the “New year, new me!” posts on social media?

I see these posts every year, and they always come from the same people. Some things never change, do they?

This isn’t always a bad thing, though. Take the January Barometer, for instance.

The January Barometer is a market indicator that basically says: “As January goes, so does the year.”

According to Banyan Hill expert Chad Shoop, editor of Automatic Profits Alert: “It’s the catchy saying to remember the January Barometer. Its insight is simple. The direction that January takes predicts how the S&P 500 Index will do throughout the rest of the year.”

As with all market indicators, it’s not 100% accurate. If there were such a thing, we’d all be out of work, right?

But the January Barometer is on the mark often enough that it’s endured the test of time. In fact, since 1938, the indicator has a 70% accuracy rating.

So, 70% of the time, it works every time.

But enough from me on the topic. Chad has an excellent, full-blown write-up on the January Barometer: “The January Barometer — A Broken Instrument or Valuable Tool?”

And, if you find yourself jonesing for more of Chad’s excellent market insight, why not sign up for Automatic Profits Alert today?

Finally, don’t forget to check out Great Stuff on social media. If you can’t get enough meme-y market goodness, follow me on Facebook, Twitter and Instagram!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing

from Timor Invest https://ift.tt/2MH58s4